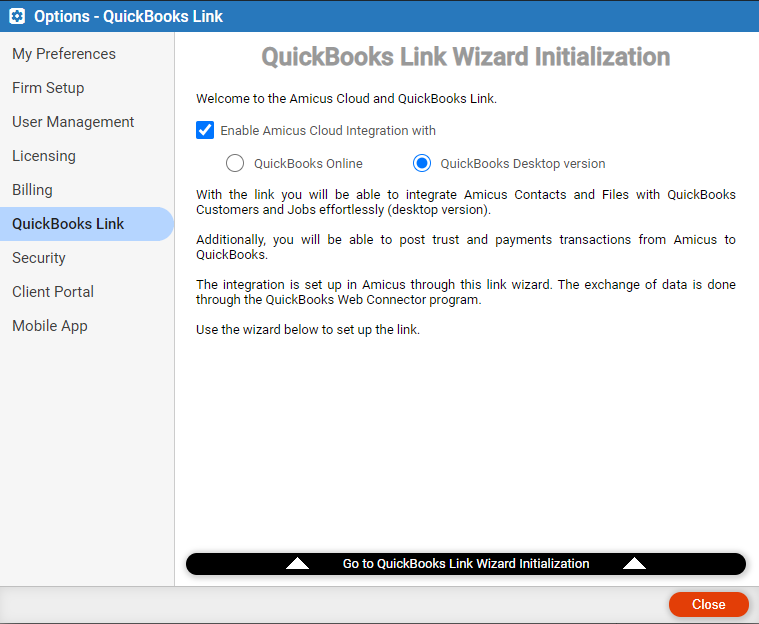

and select QuickBooks Link from the left pane,

check Enable Amicus Cloud Integration

with and select the QuickBooks

Desktop version radio button.

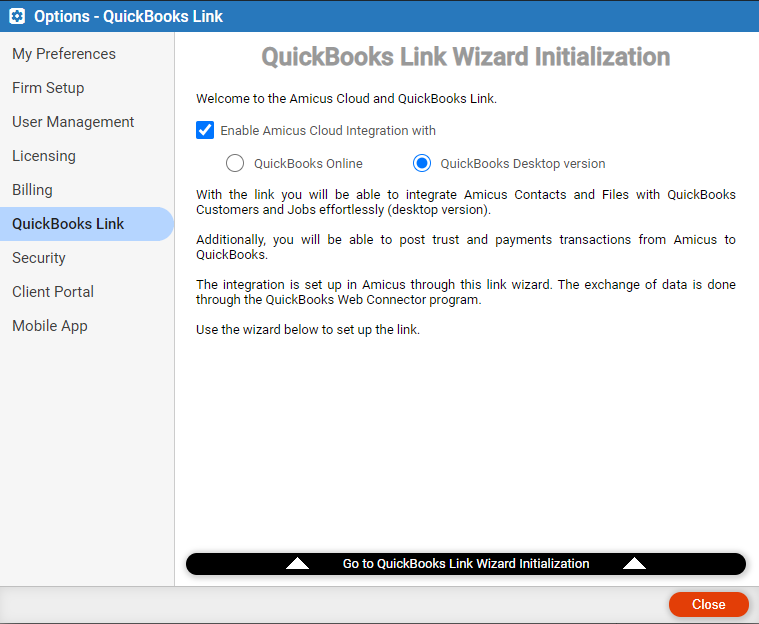

and select QuickBooks Link from the left pane,

check Enable Amicus Cloud Integration

with and select the QuickBooks

Desktop version radio button.

[FOR AMICUS ADMINISTRATOR ONLY]

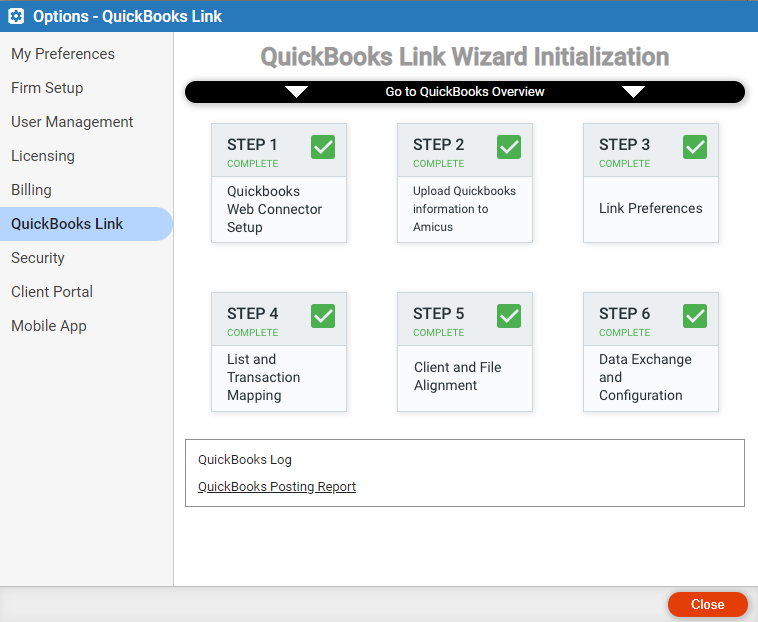

Before using the QuickBooks Link on a day-to-day basis, you must first perform some installation and configuration steps and a first exchange. The Amicus QuickBooks Link Wizard guides you through this process.

● Who and where – As the Amicus administrator, initialize the Link on the computer where the firm's QuickBooks software and database (company file) is installed. (Subsequently, the Link can be run by any user who may open QuickBooks (as a QuickBooks billing supervisor) and run the QuickBooks Web Connector at that computer.)

● Step 1: QuickBooks Web Connector setup

● Step 2: QuickBooks information upload

● Step 4: Lists and transaction mapping

● Step 5: Client and file alignment

● Choose Options  and select QuickBooks Link from the left pane,

check Enable Amicus Cloud Integration

with and select the QuickBooks

Desktop version radio button.

and select QuickBooks Link from the left pane,

check Enable Amicus Cloud Integration

with and select the QuickBooks

Desktop version radio button.

● Click the "Go to QuickBooks Link Wizard Initialization" bar.

● Click the step buttons to start, resume, or redo the steps. Complete each of the substeps in each of the 6 main steps.

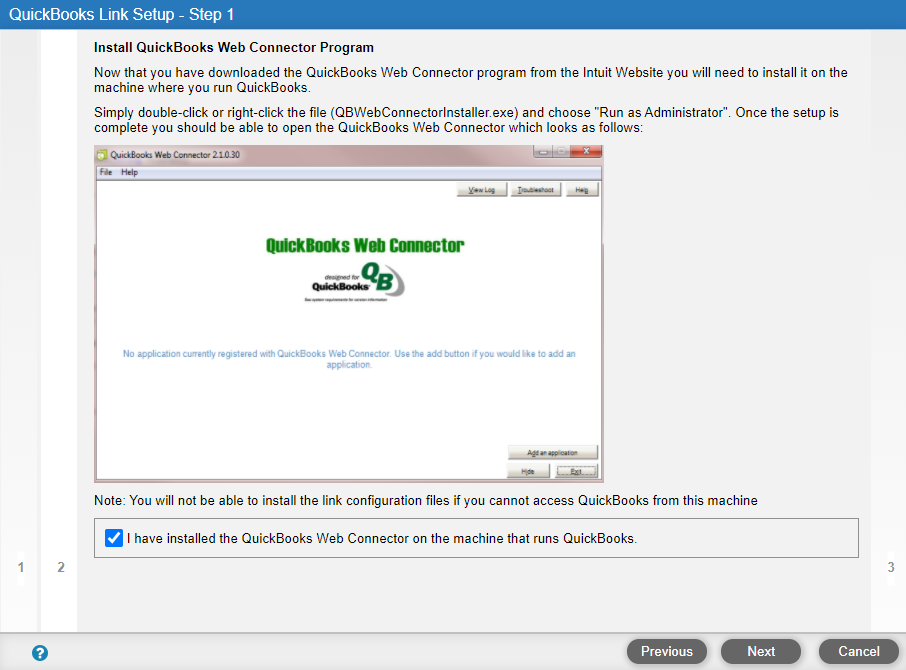

1. Click

STEP 1 and Download the

QuickBooks Web Connector software.

2. Install

the QuickBooks Web Connector.

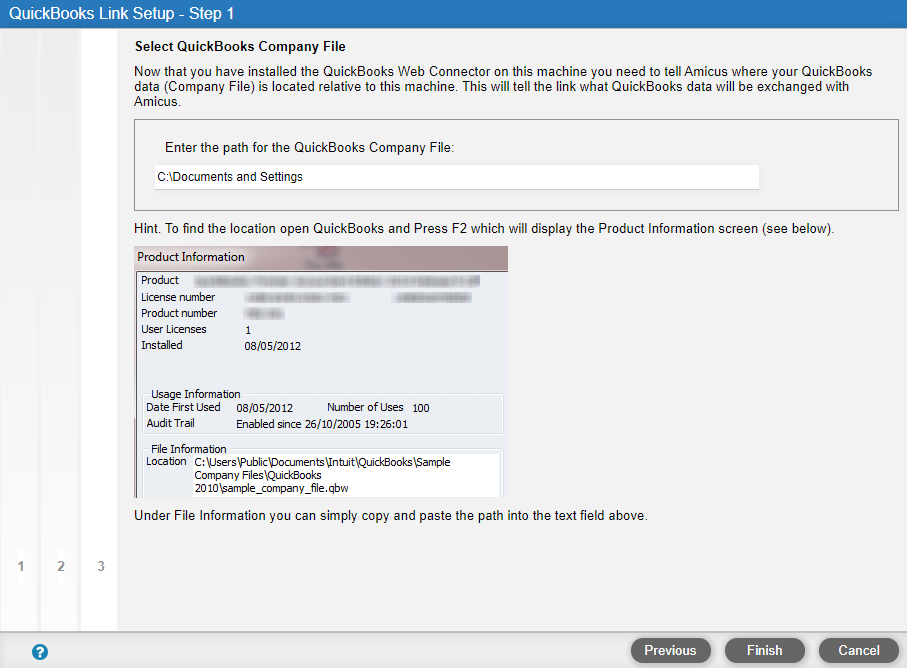

3. Identify the location of your QuickBooks data (company file).

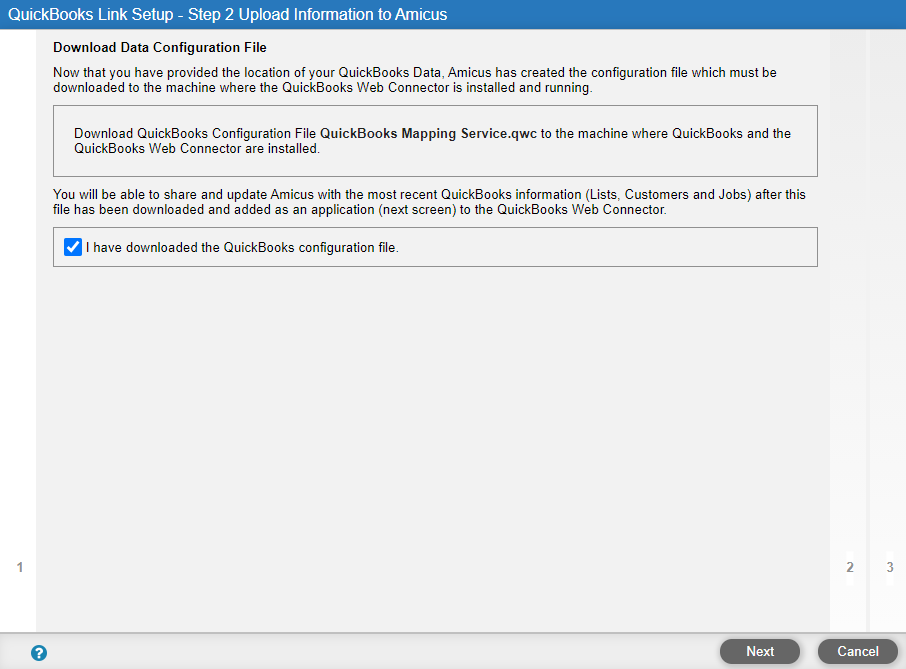

1. Download

the QuickBooks Mapping Configuration file.

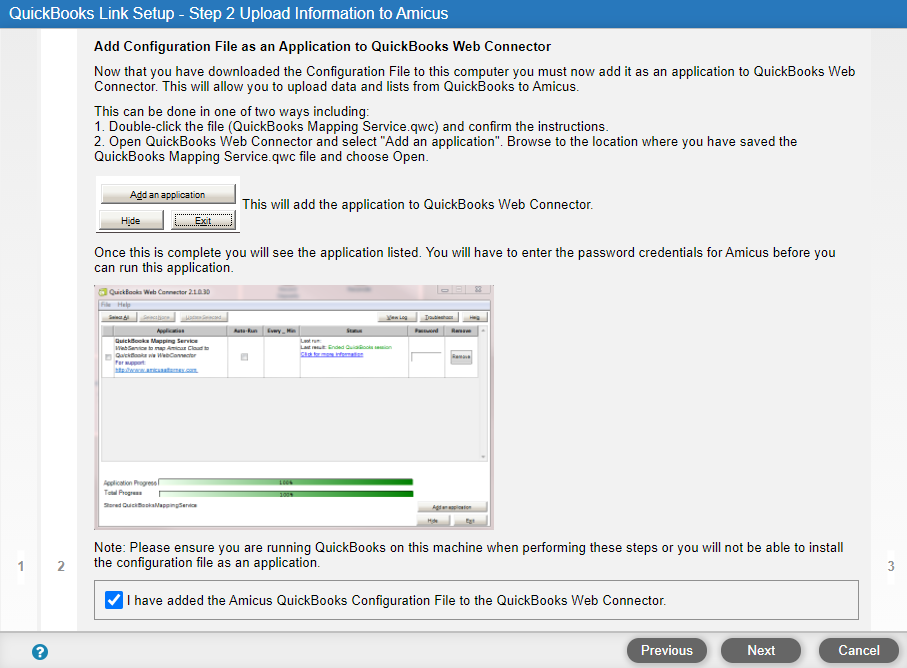

2. Add

the QuickBooks Mapping Service file as an application to the QuickBooks

Web Connector. Enter your Amicus password.

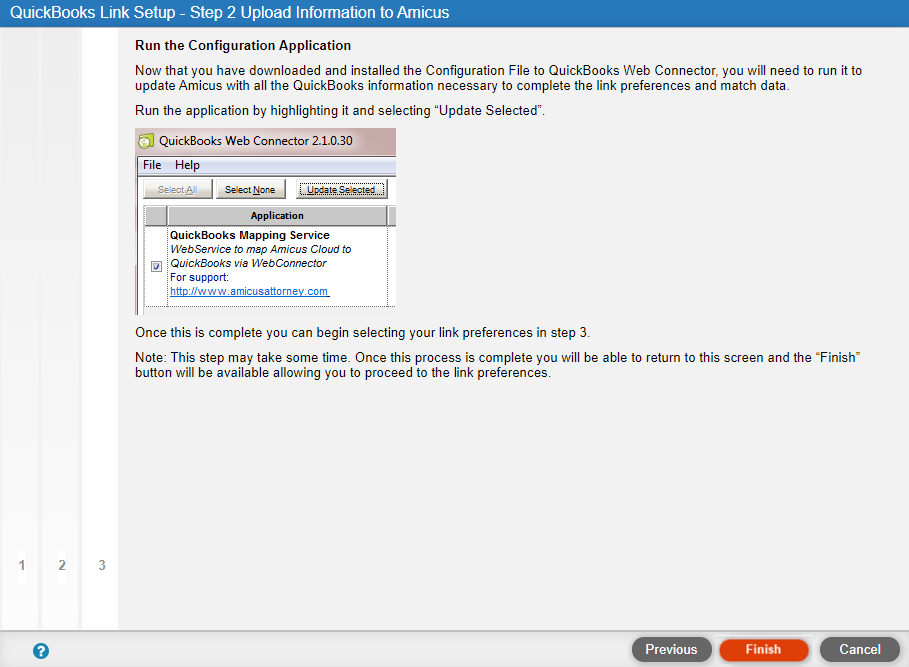

3. Run

the QuickBooks Mapping Service—select its checkbox and click Update Selected.

This uploads to the cloud your QuickBooks data needed to complete the

Wizard, including job types, sales reps, GL accounts, customers, and jobs.

|

Note: Conflicts are resolved based on the Link priority options set by Amicus Administrator. |

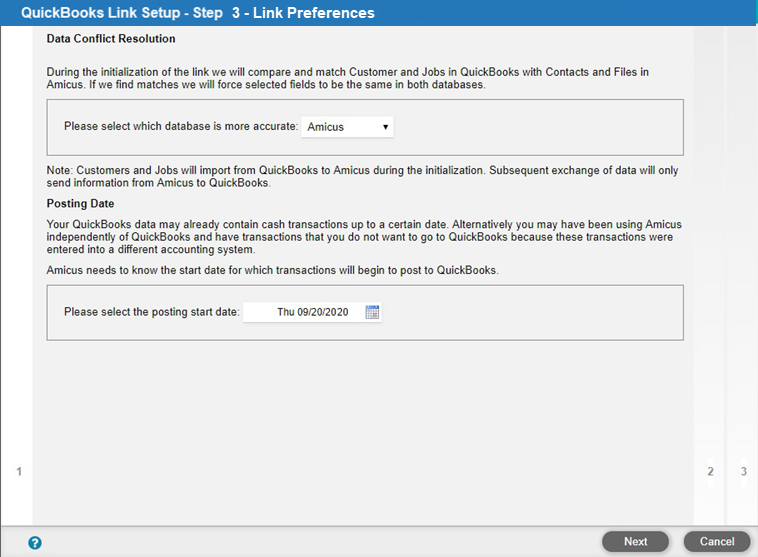

1. Choose whether QuickBooks or Amicus has the more accurate data, to determine which program's record overwrite the other in cases where matching records exist in both programs. This affects initialization but not subsequent exchanges.

o Choose a posting start date for Amicus payment (and optionally trust) transactions to be exchanged to QuickBooks.

2. Choose which set of identifiers will be used to match QuickBooks customers and jobs with Amicus clients and files:

o Client ID/Matter ID — QuickBooks customer name matches Amicus client ID, and QuickBooks job name matches Amicus matter ID.

o QuickBooks ID/File Name — QuickBooks customer

name matches Amicus contact QuickBooks ID field, and QuickBooks job name

matches Amicus file name.

Indicate whether, for customers who are individuals, their name format

in QuickBooks is "First Name Last Name" or "Last Name,

First Name". This affects the automapping of QuickBooks customers

with Amicus contacts, the visual display of Amicus names in Step 5 mapping

lists, and the actual names exchanged from Amicus to QuickBooks.

The QuickBooks ID field is shown in Amicus contact details only if the

corresponding option is selected here.

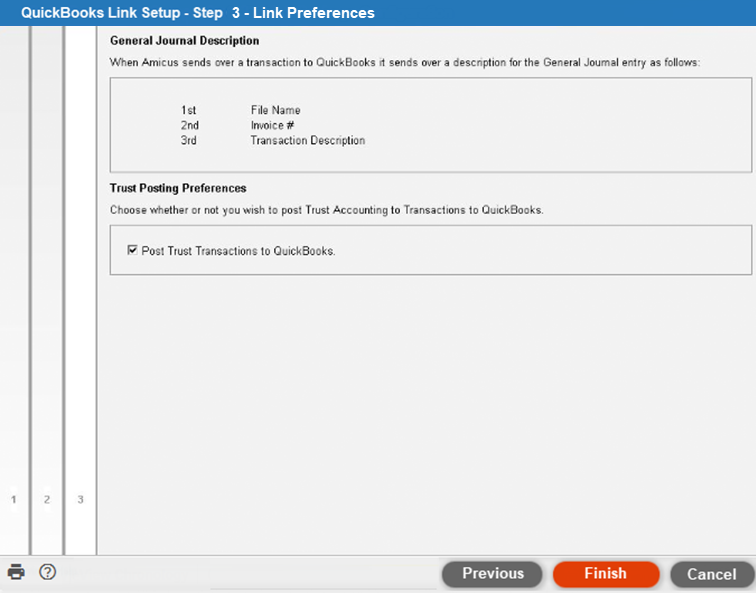

4. Choose whether

to exchange Amicus trust transactions

to QuickBooks.

1. Map

all Amicus file types to QuickBooks job types. To add an unmapped

QuickBooks job type to Amicus as a new file type, select it and click

Add to Amicus.

Any QuickBooks job with an unmapped job type won't be exchanged. Any Amicus

file with a new (unmapped) file type won't be exchanged, and the file

type will be added in red to this screen.

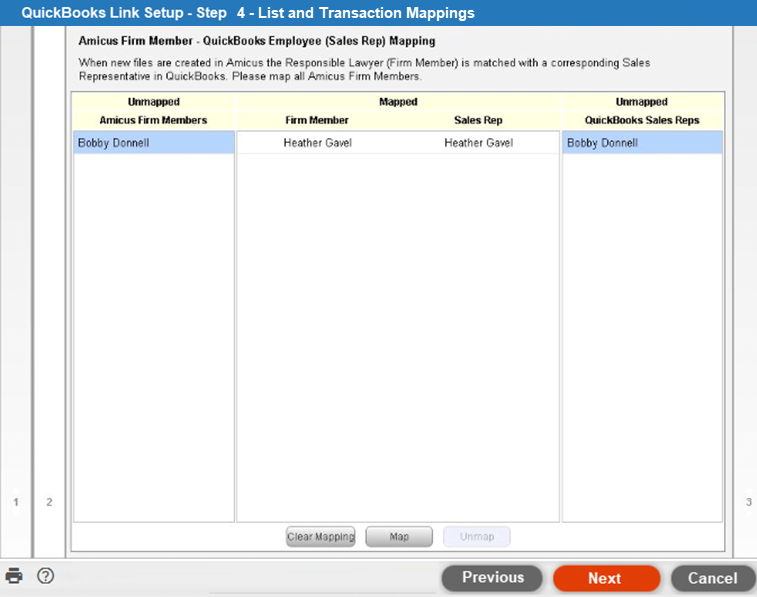

2. Map

all Amicus firm members to QuickBooks sales reps. Manually add

firm members or sales reps in the respective programs first if necessary.

This mapping determines which firm member will be assigned as responsible

lawyer on any files created in Amicus, and which sales rep will be assigned

to the customer on any jobs created in QuickBooks.

Any QuickBooks job with an unmapped sales rep won't be exchanged. Any Amicus

file with a new (unmapped) firm member as responsible lawyer won't be

exchanged, and the firm member will be added in red to this screen.

3. Map

all Amicus accounts to QuickBooks General Ledger accounts. You

can map multiple Amicus accounts to the same QuickBooks account if you

wish.

The three basic Amicus accounts are General Bank, Fee Revenue, and Expense

Revenue. If you've set the Link to exchange trust transactions, then two

Trust Bank categories are listed for each Trust Bank Account defined in

Amicus: a Trust Checks account and a Trust Receipts account. If taxes

are enabled in any Amicus files, then a Tax 1 Liability account (and a

Tax 2 Liability account if necessary) will be listed.

| Amicus Accounts | QuickBooks Accounts (suggested) |

General Bank Account GL |

Undeposited Funds (Asset) account.

TIP: We recommend subsequently depositing funds to the appropriate General Bank account in QuickBooks. |

Fee Revenue Account GL |

Legal Fee Revenue account. |

Expense Revenue Account GL |

Typically, an Expense or Asset account. |

[Trust Bank Accounts] Trust Bank Accounts (as specified in your Options > Billing > Trust Accounts list), and only if you've configured the Link to exchange Trust transactions. For each Trust Bank Account specified in Amicus, two are provided for mapping: a Trust Check account and a Trust Receipt account. |

If you wish to use the Undeposited Funds (Asset) account, you should map Trust Checks and Trust Receipts to different QuickBooks accounts. TIP: If you wish to use a single account for both Trust Checks and Trust Receipts, consider mapping both Amicus accounts to a QuickBooks clearing (exchange) account. This enables a QuickBooks user to print checks and receipts against this clearing account, upon which the funds would be transferred as appropriate. |

Trust Liability Account GL Client Funds in Trust Only shown if you've configured the Link to exchange Trust transactions. |

Client Trust Account

|

Tax 1 Account GL Only if Tax 1 is applied by the firm for one or more non-closed, billable files. |

A clearing (exchange) Liability account. Do NOT map the real QuickBooks Tax Liability account. |

Tax 2 Account GL Only if Tax 2 is applied by the firm for one or more non-closed, billable files. |

A clearing (exchange) Liability account. Do NOT map the real QuickBooks Tax Liability account. |

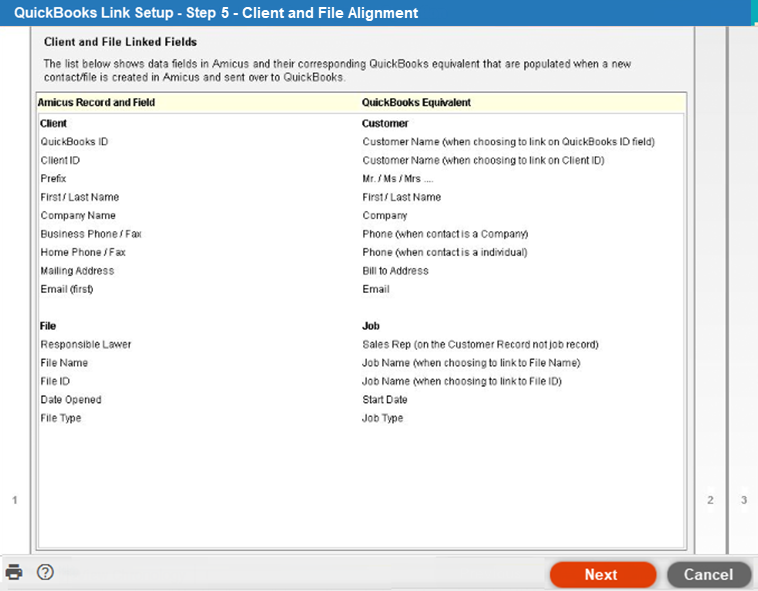

1. Read

which Amicus contact and file fields correspond to which QuickBooks customer

and job fields. For more details, see QuickBooks

Link - What does it exchange?

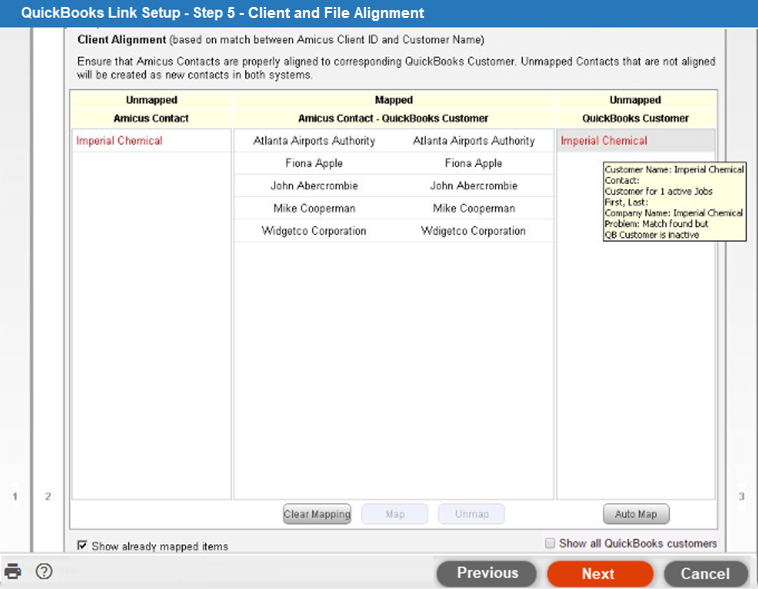

2. Map Amicus contacts to QuickBooks customers. (Or unmap ones that have been improperly mapped.) Items are automatically mapped based on the identifiers you chose earlier (IDs or names).

o Unmapped contacts/customers shown in black in the outer columns are ones that will be added as new items in the other program during initialization (or from Amicus to QuickBooks only during subsequent exchanges.

o Unmapped contacts/customers shown in red in the outer columns are ones that won't be exchanged during initialization (or subsequent exchanges) due to problems that are shown upon mouse over.

o Mapped contacts/customers shown in black in the center column are ones that will be next exchanged. During initialization, either the Amicus records overwrite QuickBooks records or vice versa, depending on which program you said has the most accurate data. (In subsequent exchanges, the Amicus records will overwrite QuickBooks records.)

o Mapped contacts/customers shown

in grey in the center column are ones that have already been exchanged.

● Amicus contacts are listed only if they are primary clients on one or more non-closed, billable files.

● QuickBooks

customers are normally listed only if they are active customers

on one or more active jobs. Customers only on closed, not awarded, or

pending jobs are not listed.

Or select the Show all QuickBooks customers option

to also list (in italics) the active customers who are not on any active

jobs. These customers must have a last name and/or company name. If you

map one to an Amicus contact, initialization will create a job in QuickBooks

from the contact's file in Amicus.

3. Map Amicus files to QuickBooks jobs. (Or unmap ones that have been improperly mapped.) Items are automatically mapped based on the identifiers you chose earlier (IDs or names).

o Unmapped files/jobs shown in black

in the outer columns are ones that will be added as new items in the other

program during initialization (or from Amicus to QuickBooks only during

the next subsequent exchange).

o Unmapped files/jobs shown in red

in the outer columns are ones that won't be exchanged during initialization

(or subsequent exchanges) due to problems that are shown upon mouse over.

o Mapped files/jobs shown in black

in the center column are ones that will be next exchanged. During initialization,

either the Amicus records overwrite QuickBooks records or vice versa,

depending on which program you said has the most accurate data. (In subsequent

exchanges, the Amicus records will overwrite QuickBooks records.)

o Mapped files/jobs shown in grey

in the center column are ones that have already been exchanged. (These

appear only after initialization.)

o WE RECOMMEND YOU CLEAN UP THE RED ITEMS - change

in Amicus then return to this screen, and/or change in QB then run 1st

service again then return to this screen to confirm now mapped or black?

● Amicus files are listed only if they are non-closed files with a primary client assigned.

● QuickBooks jobs are listed only if they are active jobs with an active customer assigned.

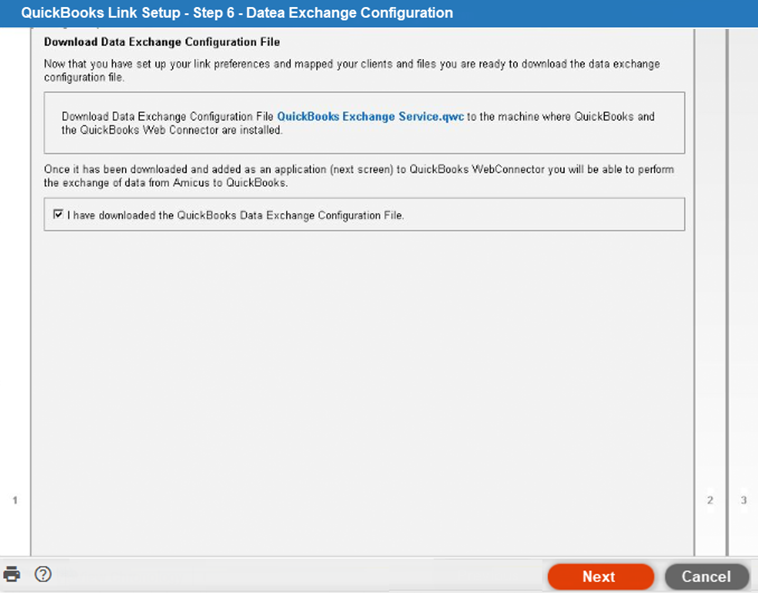

1. Download

the QuickBooks Exchange Configuration file.

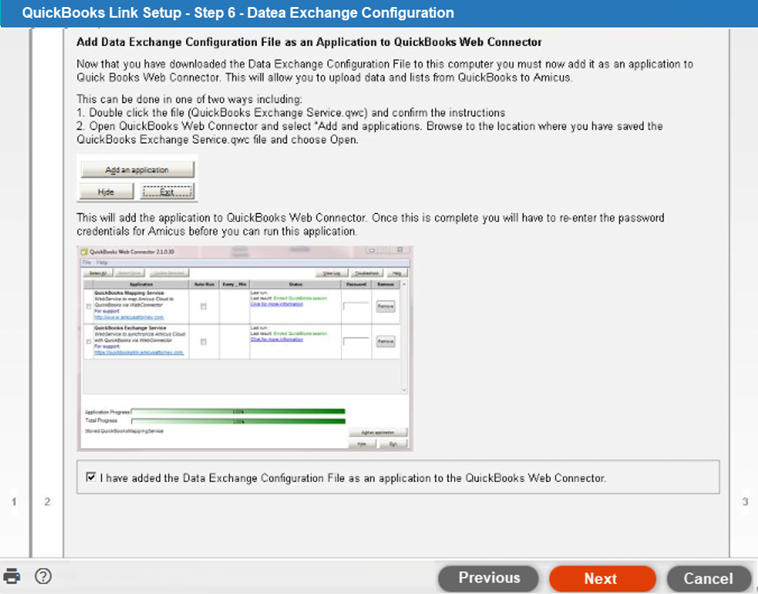

2. Add

the QuickBooks Exchange Service file as an application to the QuickBooks

Web Connector. Enter your Amicus password.

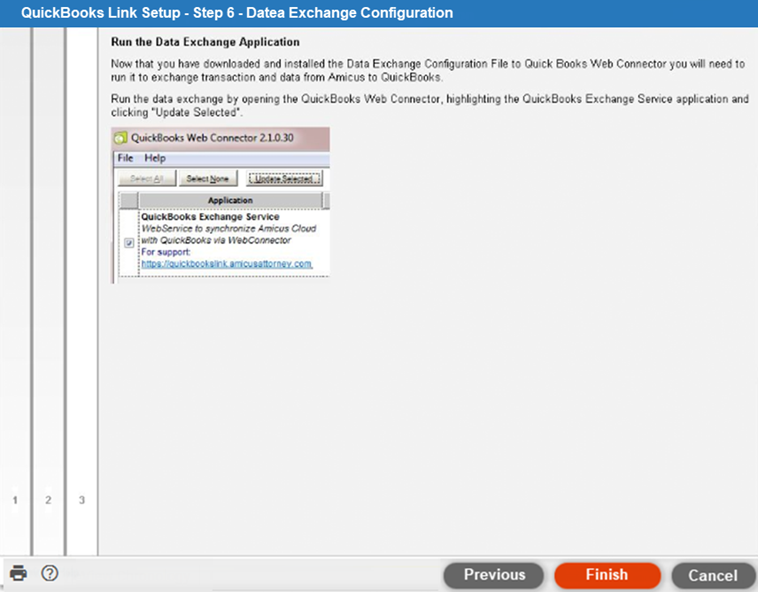

3. Run the QuickBooks Exchange Service. (Select its checkbox and click Update Selected.) This performs the first exchange, completing the initialization process:

o Mapped clients/customers and files/jobs are updated in Amicus/QuickBooks and linked.

4. Unmapped

clients/customers and files/jobs without problems are added to Amicus/QuickBooks

and linked.

5. Consult the

QuickBooks Posting Report, available from the

first page of the QuickBooks Link wizard.

● QuickBooks Desktop Link - What is it?

● QuickBooks Desktop Link - How to use it

● QuickBooks Desktop Link - What does it exchange?

Amicus Cloud (July 2023)

Copyright